is a tax refund considered income for unemployment

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. The child doesnt file a joint tax return for the year.

Is Your Unemployment Income Refund Taxable Gobankingrates

The IRS has sent 87.

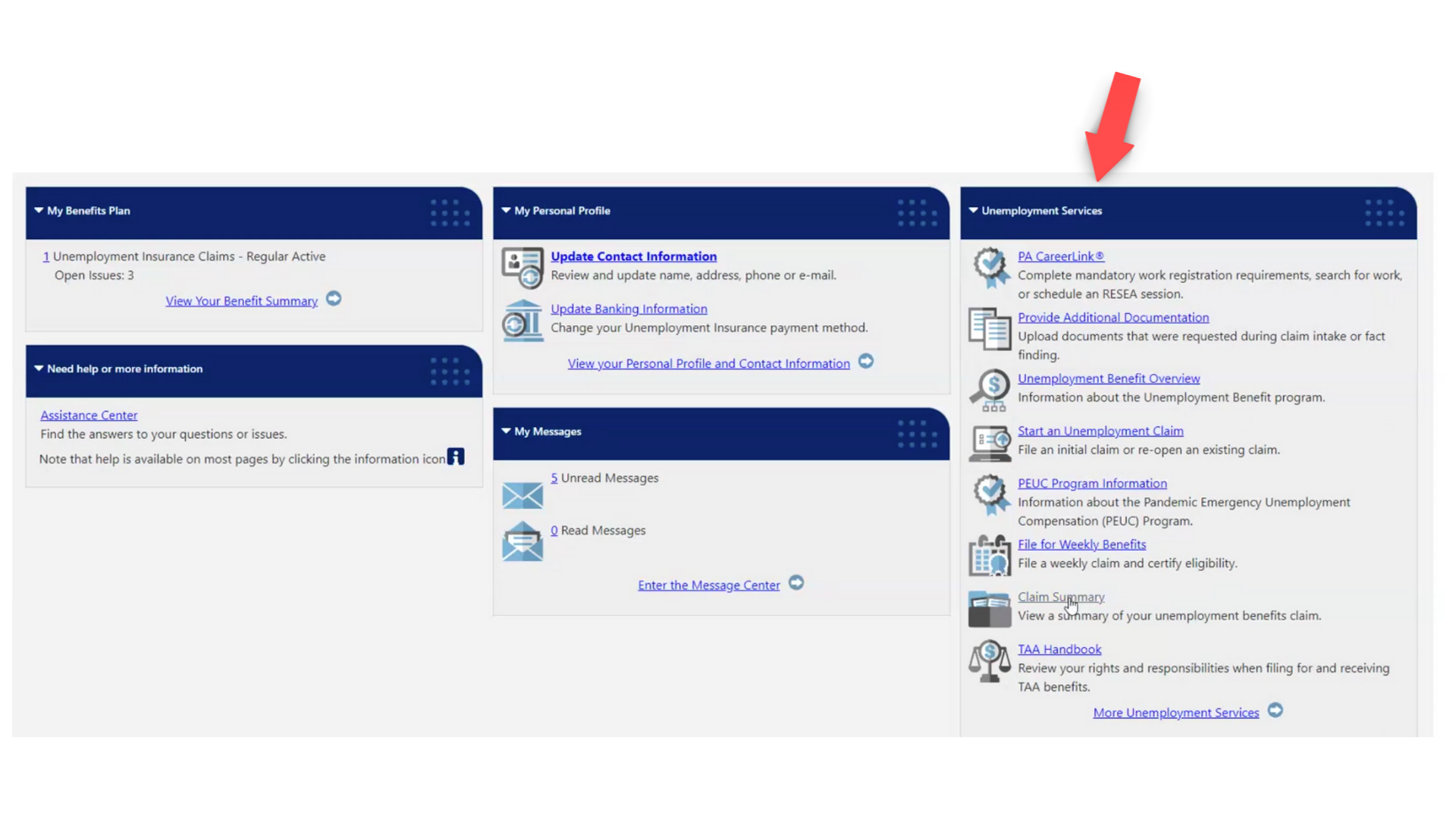

. The refunds you receive from your state income tax returns may be considered income. If you received unemployment benefits in 2020 a tax refund may be on its way to you. The questions indicates that you are in the incorrect data entry for the unemployment compensation form 1099-G you have somehow selected Other 1099-G.

Unemployment income is considered taxable income and must be reported on your tax return. Make sure you include the full amount of benefits received and any withholdings on your tax return. How much will I get back from unemployment taxes.

The federal tax code counts. 10200 in unemployment income in 2020 will still. Youre eligible for the tax refund if your household earned less than 150000 regardless of filing status.

So if you collected unemployment benefits in 2021 you should expect 100 of your benefits to be included in your taxable income when you file your 2021 tax return. If you are a New York State part-year resident you must file Form IT-203 Nonresident and Part-Year Resident Income Tax Return if you meet any of the following. Tax season started Jan.

Include this total on the Total New York State tax withheld line on your New York State income tax return. It relates to income taxed a year ago. Prepare federal and state income taxes online.

Married couples who file jointly and where both spouses were. 24 and runs through April 18. The child is required to file a tax return for the year.

The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate income workers who have worked and earned income under the amount of 57414 in 2021. This is different from the 2020 tax year when the. Taxpayers with the simplest tax returns will receive refunds on taxes paid on 2020 unemployment insurance benefits first.

Unemployment compensation is considered taxable income by the IRS and most states thus you are required to report all unemployment income as reported on Form 1099-G. If you received unemployment income during 2021 the amount counts toward your taxable income according to the IRS. The refund is not income.

IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer. Curt Harrington Patent Tax Law Attorney Certified Tax Specialist by the California Board of Legal. 1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true.

To help understand the logistics lets look at an example. Those with one child could. It depends on whether you deducted state and local income taxes in your tax returns the.

A married couple filing jointly who earn below 56844 and have three or more children can claim for the full 6660 in the current 2020 tax year. If the amount of advance credit payments you get for the year is less than the tax credit you should have received youll get the difference as a tax credit when you file your federal income. It is included in your taxable income for the tax year.

Total the New York State tax withheld amounts from all IT-1099-UI forms. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Unemployment 10 200 Tax Break Some States Require Amended Returns

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds

Unemployment Benefits Tax Issues Uchelp Org

Unemployment Benefits Tax Free Do You Need To Amend Your 2020 Tax Return Youtube

Tax Issues With Unemployment Benefits Get More Complicated Wgrz Com

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Unemployment Tax Refund Could Put Thousands Back In Your Pocket

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Unemployment 10 200 Tax Break Some States Require Amended Returns

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

When Will Unemployment Tax Refunds Be Issued King5 Com

/cloudfront-us-east-1.images.arcpublishing.com/dmn/C24E5T74ZBHEVHTLWO4DIISVM4.jpg)

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

Taxes 2021 What To Expect For The 2021 Tax Season Tax Foundation

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back